- Reduce exposure to data breaches by replacing sensitive payment credentials with randomly generated token numbers

-

Foster customer trust and loyalty by keeping customer data safe

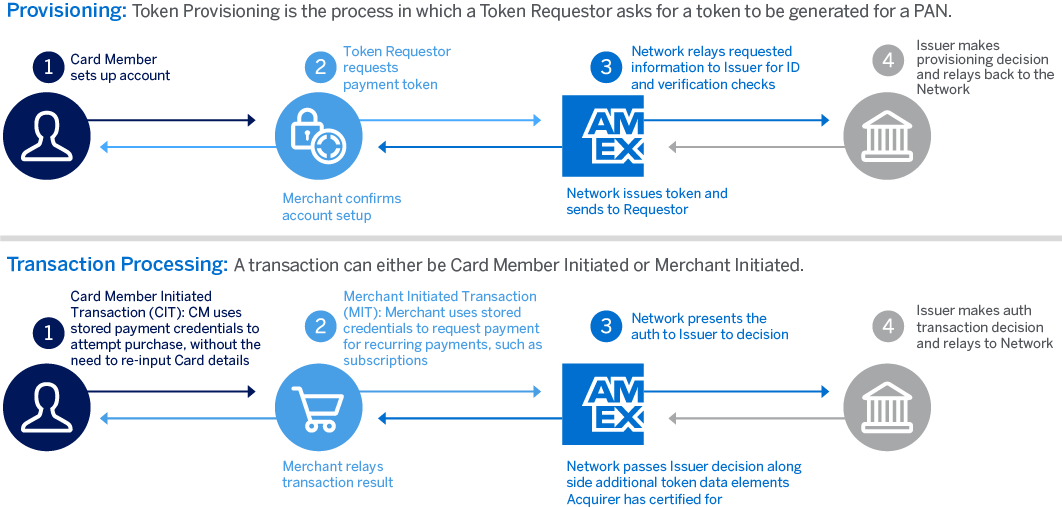

American Express Tokenization Service helps create a safer online and mobile payments environment for consumers by replacing a card’s primary account number (PAN) with a unique surrogate value that may be used to conduct payment transactions. Tokenization is becoming increasingly popular with Issuers and Merchants due to the security benefits it provides. Payment tokens in particular, allow for a seamless payment journey that is transparent to the Card Members without impacting Merchant revenue continuity.

The American Express Tokenization Service is a suite of solutions that includes a token vault, payment token issuing and provisioning, token lifecycle management, and risk services to help prevent fraud.

There are two types of tokens: security tokens and payment tokens. American Express supports the provisioning and generation of payment tokens. The American Express Token Service is available for Card Issuers, Acquirers, and Merchants on the American Express Network.

Data Breach Protection

Foster customer trust and loyalty by keeping customer data safe

Reduced Fraud and Risk

Payment tokens can be generated according to strict domain controls, aiding with transaction processing decisions and reducing risk of fraud

Less Payment Disruptions and Protected Revenue

Tokens are managed according to a card and device’s latest information and status, eliminating the need for Card Member’s to manually update card information—helping to provide a quick and frictionless experience for the customer and reducing payment disruptions for the Merchant

Reduced PCI Scope

By storing tokens instead of card credentials, Merchants can minimize the need for PCI compliant infrastructure and PCI audit requirements

American Express Card-on-File (CoF) Tokenization utilizes American Express Tokenization Service to replace actual card data for tokens to be stored and used in transaction processing. This service differentiates itself from other tokenization use cases (digital wallets, wearables), focusing on online and e-commerce stored credentials transactions.

For Issuers

For more information, click here or contact your American Express Representative.

For Direct Merchants

For more information, download the American Express Token Service Overview or visit the American Express Token Service Developer portal.

For Token Aggregators

Click here to verify that Card-on-File Tokenization is available in the country in which you operate. If your target country is not listed, please contact tokenapprovals@aexp.com.

Register your company and individual users for Amex Enabled access in order to review the Tokenization Implementation Guide. Instructions can be found here, under ‘How to Register’.

All digital wallet implementations use American Express Tokenization Service to store tokens instead of Card data—helping to protect payment cards in mobile devices. Whether the card is used in-app or at a PoS terminal, card data is tokenized and the authorization request from the Merchant to the Network is secured with the token.

To learn more about American Express Digital Solutions, click here

Click to Pay is enabled by EMV® Secure Remote Commerce (SRC), a technical framework that aims to bring familiarity and consistency to the online checkout experience. Designed to provide payment choice and convenience, Click to Pay enables Merchants to offer multiple card types in an easy, online checkout experience across websites, mobile apps, and other digital channels. Click to Pay utilizes American Express Tokenization Service to replace actual card data with a token that is passed along during the authorization process, helping to provide a more secure payment method for online, digital, and mobile commerce. A Token is generated and linked to a Card Member PAN after Click to Pay enrollment. That token can be used across Service Establishments (S/Es) if they are certified for tokenization and can be managed by an Issuer or a Card Member.

To learn more about Click to Pay, click here.

As payment technology evolves and customers seek new ways to pay, QR Codes are becoming more popular as an alternative solution for Merchants and Issuers to expand their customer’s payment options and use their mobile devices to pay.

Tokenization is available for the Consumer Presented QR Code (CPQR) solution. In this solution, the consumer generates a QR Code for a Merchant to scan. American Express Tokenization Service is used to secure card data information, which is passed in the authorization request between the point of interaction, the Acquirer, the Network, and the Issuer.

To learn more about QR Codes click here.

An error occurred while transmitting your feedback. We apologize for the inconvenience, please try again later.

Thank you for completing the feedback form. Your comments have been submitted successfully.