American Express SafeKey®

Prevent fraud while reducing friction for online transactions

Overview

The growth of digital commerce has placed greater emphasis on Merchants and Issuers to enhance their fraud prevention techniques while ensuring their customers can transact quickly and easily on whatever device they choose.

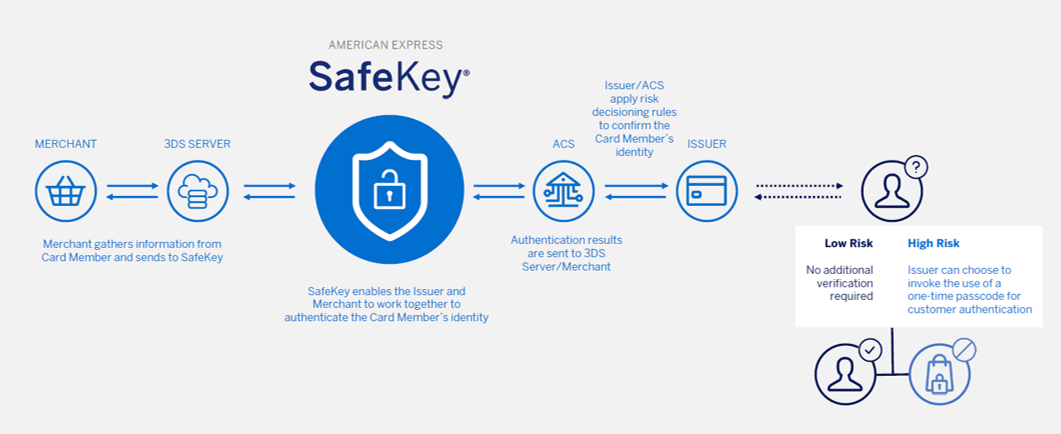

American Express SafeKey is a security solution that leverages the global industry standard, EMV® 3-D Secure, to detect and reduce online fraud—providing an extra layer of security when consumers shop through web browsers or in-app.

SafeKey enables Merchants and Issuers to exchange detailed information, which helps reduce fraud and minimize the need for a one-time passcode—improving the user experience and reducing shopping cart abandonment.

Building consumer confidence can help expand your market reach. Enhanced fraud protection through SafeKey may encourage online customers to spend more and help grow your business. Enroll in SafeKey today!

EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo.

Benefits

Merchants

Improve Spend Confidence

-

Helps customers feel more secure about online purchases potentially increasing their confidence to spend

Reduce Shopping Cart Abandonment

- Additional data elements from the checkout process can allow Issuers to authenticate a Card Member without a 'challenge'* reducing friction which can lead to less cart abandonment and a higher conversion of sales

Reduce Fraud Liability

- Transfers liability for fraud chargebacks on SafeKey authenticated transactions from the Merchant to the Issuer

- Which may result in fewer chargebacks

- Works alongside other tools to help manage fraud

*A ‘challenge’ is when an Issuer can request the Cardmember to prove his/her identity, e.g. by use of a One-Time Passcode (OTP).

Issuers

Reduce Fraud

-

Helps lower fraud with an extra layer of security

-

Provides additional data for sophisticated risk decisions

Authenticate Securely

-

Richer data allows targeting of higher risk transactions where stronger customer authentication would be beneficial

-

Supports a variety of Issuer authentication methods, including one-time passcodes, biometrics, and out-of-band

Implement a Global Standard

- Adheres to the industry-standard EMVCo 3-D Secure protocol

- Supports individual market regulations, such as PSD2 (in Europe)

Increase Customer Confidence

-

Helps increase Cardmember confidence by reducing friction, which can lead to reduced cart abandonment - potentially increasing sales

Cardmembers

- Helps protect against the fraudulent use of Cardmember details

-

Cardmembers automatically enrolled by their Issuers

-

Includes protection for transactions made on web browsers and in app

SafeKey Version Comparison

| Features | SafeKey 2.0 | |

|---|---|---|

| SafeKey 2.2

|

SafeKey 2.3

|

|

| App-based (in-app) enablement |

|

|

| Non-payment authentication |

|

|

| Token-based transactions |

|

|

| Out-of-band authentication |

|

|

| 3DS Requestor-Initiated (3RI) non-payment authentications |

|

|

| 3DS Requestor-Initiated (3RI) payment authentications |

|

|

| Decoupled authentication |

|

|

| PSD2 data elements and indicators |

|

|

| Additional support for gaming consoles and headless devices |

|

|

| Support for Secure Payment Confirmation |

|

|

| Automated out-of-brand transitions and UI enhancements |

|

|

| Enhanced data for additional payment scenarios |

|

|

SafeKey specifications can be accessed through AMEX Enabled and Knowledge Base.

How It Works

Enrollment & Implementation

ACS & 3DS Server Provider

1.Click here to register your company with the AMEX Enabled Program

(Please note SafeKey merchants DO NOT need to register and should contact their Payment Service Provider to set up SafeKey)

2. Enroll users to access the AMEX Enabled Dashboard

3. Log in to the AMEX Enabled Dashboard to access certification documentation

4. When ready to start SafeKey certification, complete and submit Product Enrollment form (link provided in AMEX Enabled confirmation email)

5. A Certification Analyst will be in touch with next steps

Note: Existing providers wishing to uplift to a newer version of SafeKey should log into AMEX Enabled, complete the Uplift Questionnaire and email it to safekey.certification@aexp.com to start their certification.

SDK

A Merchant’s app processes SafeKey transactions using a Software Development Kit (SDK). SDK Providers are required to enroll with American Express to provide proof of their EMVCo certification.

1. Click here to register your company with the AMEX Enabled Program

2. Enroll users to access the AMEX Enabled Dashboard

3. Log in to the AMEX Enabled Dashboard and read the "SDK SafeKey Instructions" document for next steps

4. When ready to enroll, complete a Product Enrollment form (link provided in AMEX Enabled confirmation email) for each EMVCo SDK Reference Number

Issuer

Please contact your American Express representative if you would like to certify for SafeKey.

Acquirer

Please contact your American Express representative if you would like to certify for SafeKey.

Merchant

Please contact your 3DS Server / PSP if you wish to enable SafeKey or contact your Amex representative for more information.

ACS & 3DS Server Provider

1.Click here to register your company with the AMEX Enabled Program

(Please note SafeKey merchants DO NOT need to register and should contact their Payment Service Provider to set up SafeKey)

2. Enroll users to access the AMEX Enabled Dashboard

3. Log in to the AMEX Enabled Dashboard to access certification documentation

4. When ready to start SafeKey certification, complete and submit Product Enrollment form (link provided in AMEX Enabled confirmation email)

5. A Certification Analyst will be in touch with next steps

Note: Existing providers wishing to uplift to a newer version of SafeKey should log into AMEX Enabled, complete the Uplift Questionnaire and email it to safekey.certification@aexp.com to start their certification.

SDK

A Merchant’s app processes SafeKey transactions using a Software Development Kit (SDK). SDK Providers are required to enroll with American Express to provide proof of their EMVCo certification.

1. Click here to register your company with the AMEX Enabled Program

2. Enroll users to access the AMEX Enabled Dashboard

3. Log in to the AMEX Enabled Dashboard and read the "SDK SafeKey Instructions" document for next steps

4. When ready to enroll, complete a Product Enrollment form (link provided in AMEX Enabled confirmation email) for each EMVCo SDK Reference Number

Issuer

Please contact your American Express representative if you would like to certify for SafeKey.

Acquirer

Please contact your American Express representative if you would like to certify for SafeKey.

Merchant

Please contact your 3DS Server / PSP if you wish to enable SafeKey or contact your Amex representative for more information.